How worried should we be about oil tankers on the west coast?

During BC’s election campaign, Adrian Dix, Leader of the BC NDP, announced opposition to the expansion of Kinder Morgan’s Trans Mountain Pipeline. Mr. Dix has been quoted in the media as saying “We do not expect Vancouver to become a major oil export port as appears to be suggested in what Kinder Morgan is proposing.” Andrew Weaver, a Green Party MLA in BC has also predicted a large public outcry against the Trans Mountain expansion. This has made me want to explore what is exported and imported from Port Metro Vancouver, and what effect the Trans Mountain expansion would have on the volume of oil exports and tanker traffic.

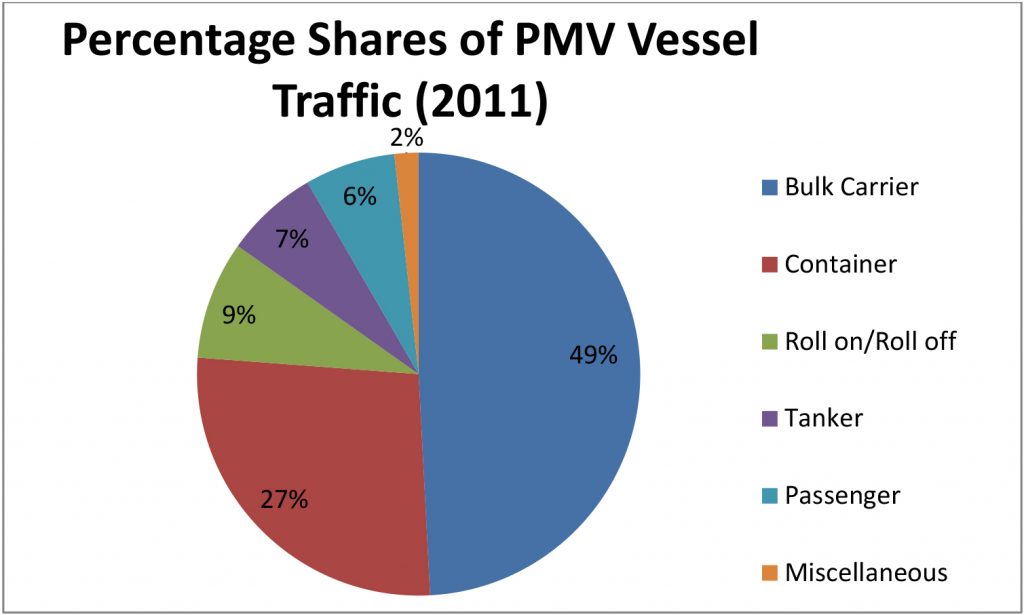

To start, let’s look at vessel traffic statistics from PMV’s 2011 Statistics Overview. The figure below shows vessel traffic from 2011. Tankers (purple) account for 7% of vessel traffic, only slightly more than cruise/passenger ships. The majority of vessels calling at Vancouver are bulk carriers.

As an additional source, Transport Canada has a website on oil tanker safety and oil spill prevention. In the description of the situation on the West Coast, the website states: “In 2009, about 8.4 million tonnes of oil were shipped out of Vancouver. Much of this oil is transported in barges to and from communities along the B.C. coast. Varying quantities of oil are also carried on board container ships, domestic and international ferries, and other types of commercial and private vessels.” The Port Metro Vancouver website notes that between 2005 and 2011, oil tankers accounted for 1.5% of foreign vessel traffic, and in 2011, 32 oil tankers called on Port Metro Vancouver. Oil tankers are currently a very small percentage of total (and tanker) traffic. I personally find it surprising that 206 tankers visited PMV in 2011, but only 16% of them were oil tankers. It seems that it would take significant expansion to convert Vancouver into a “major oil export port,” though what that means exactly is currently undefined. I will discuss increased tanker traffic a little later, but first I want to address commodities exported from PMV.

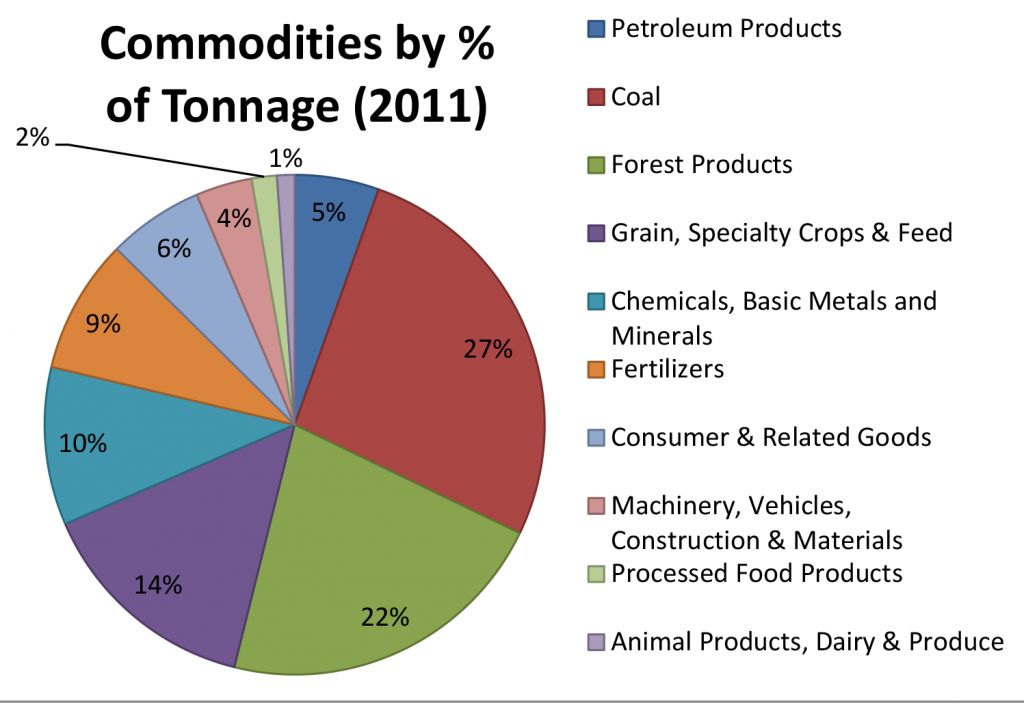

Aside from vessel traffic, it is interesting to look at the breakdown of commodities shipped to and from PMV. The figure below shows the percentage by tonnage for various commodity groups for 2011. Almost 50% of commodity traffic at PMV is coal and forest products; petroleum products (blue) have a small 5% share by tonnage. Of the 6.67 million tonnes of petroleum products handled by PMV in 2011, 36% was crude oil; the remainder was gasoline, diesel and fuel oils, aviation and jet fuel, and kerosene, distillate and coke. Crude oil exports themselves account for only 3.1% of total tonnage between 2009 and 2011. Given how small this figure is, for Vancouver to become a “major oil export port,” crude oil exports would have to increase by at least ten-fold. The current Kinder Morgan expansion plan is to go from 350,000 barrels a day to 890,000 barrels per day, increasing the capacity by 2.5 times. Is this enough to significantly increase tanker traffic and/or make Vancouver a major oil exporter?

To answer that question, we need some more details about the pipeline system as well as the layout of the Port. The PMV website on tanker traffic states there are no plans to exceed the current maximum size tanker that calls at PMV, the Aframax class with a maximum capacity of 120,000 tonnes (this is about 750,000 barrels of oil). Additionally, it appears these tankers can only load to 80% of capacity due to draft restrictions in the Burrard Inlet. With these restrictions, a tanker could be filled every two days if the pipeline carried 100% crude oil, which is not necessarily the case. The Trans Mountain pipeline connects to the Jet Fuel System, with capacity to send 45,000 barrels per day of jet fuel to the Vancouver airport, and to the Puget Sound system, with approximate capacity of 135,000 barrels per day for crude oil and condensates.

I am not sure if the fact that Trans Mountain carries crude oil as well as refined and lighter products would be considered a mitigating factor to Mr. Dix, but for the sake of argument, let’s assume that the expansion of 540,000 barrels per day will be all crude oil, exported from PMV. This is an additional 215 million barrels per year, requiring 287 Aframax-class ships, each transporting 750,000 barrels. If the Aframax ships are operating at 80% capacity, they would transport 600,000 barrels each, requiring 359 additional ships. Based on a figure of 32 oil tankers in 2011, this is a substantial increase in tanker traffic. However, increasing the number of vessels from 3024 (2011 foreign vessel calls) by 359 is only a 10.6% increase in total vessel traffic. Based on 2011 tonnage, the Trans Mountain expansion would increase total tonnage handled by about 26%.

At the end of all this, how worried should we be about the prospect for increased tanker traffic out of PMV? The Trans Mountain expansion, assuming the entire expansion is devoted to transporting crude oil, will more than double the amount of total tanker traffic, and increase the number of oil tankers by a factor of ten. If this is the case, crude oil exports would account for approximately 30% of total tonnage handled, roughly the same as coal. It seems Mr Dix is right in that the Trans Mountain expansion would result in PMV becoming a major exporter of crude oil. That said, the increase in vessel traffic would be about 10%; vessel traffic increased 7% between 2010 and 2011. So while we may be concerned about such a sharp increase in oil tanker traffic, it is not clear that the increase in overall traffic should be of major concern.