Hybrid Cars (Part 2): Will Going Green Keep You in the Black or Put You in the Red?

In my last blog post on the subject of gasoline vs. hybrid cars, I compared a conventional gasoline powered Honda Accord to the new 2014 plug-in hybrid version and examined the total KM driven (and associated age of the vehicle) before average consumers could expect to save enough on gasoline purchases to be able to pay the added cost of owning a hybrid.

To quote from my last post:

The gasoline version has a combined city/highway mileage of 7.84 L/100km (30MPG)[1] while the hybrid has a combined city/highway mileage of 5.11 L/100km (46MPG).[2] So, for every 100 km driven, the hybrid saves about 2.73 litres of gasoline for an average driver. Last week, the average price for regular unleaded in Alberta was $1.16,[3] which means that for every 100 km, the hybrid would save its driver about $3.17.

In this post, we will look at a slightly more sophisticated analysis. I will stick with the Honda Accord gasoline vs. hybrid comparison, but rather than focus on the simple metric of a “breakeven point,” I will illustrate the return on investment in a hybrid. This treats the additional expense of a hybrid like we would any other financial investment (mutual funds, guaranteed income certificates or even high interest savings accounts).

Recall from my last post that a standard 2014 gasoline Accord (LX model with V6 engine and manual transmission) carries a manufacturer’s suggested retail price of $23,990 (Canadian). The plug-in hybrid model has an MSRP of $29,590. Given that the equipment on these two models is basically identical, the increased fuel economy of the hybrid will cost a consumer $5,600.[4]

To calculate the return on this $5,600 investment, we look at the combination of cost savings (total dollars saved on gasoline given the vehicle’s total km driven) and the additional resale price of a hybrid when compared to conventional gasoline model. To determine the expected resale price of a used 2014 Honda Accord (both hybrid and gasoline) I use data from an Edmunds.com info-graphic.[5] Factoring in the resale price (assuming that both the gasoline and hybrid models depreciate at the same rate) we can work out the return on investment in a hybrid under a few different scenarios. I will start by looking at how variation in the retail gasoline price affects the return on investment in a hybrid.

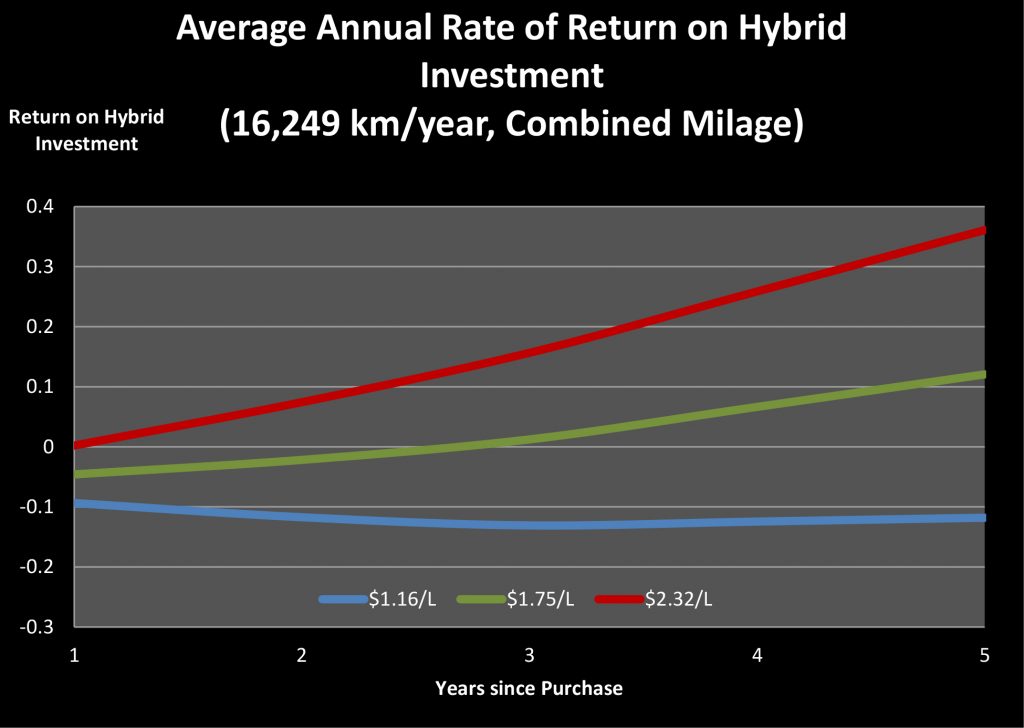

Figure 1: Annual Average Rate of Return on Hybrid Investment of $5,600

Assuming that a hybrid owner drives the Canadian average (16,249km /year),[6] at current Calgary gasoline prices (approximately $1.16/L at the time I did these calculations), [7] the hybrid investment fails to earn a positive return inside a five year window (the blue line in Figure 1, above). In econ wonk terms, the additional depreciation on the higher-cost hybrid is greater than the value of the fuel-economy-related savings. If gas prices were to increase by 50% to$1.75/L, the return becomes positive after 3 years, and sits at 12% over five years of ownership (green in the above figure).

At a gas price of $2.32 (double the current Alberta price) the return is positive after just over 1 year, and is in excess of 25% (for perspective, the return on a 5 year government bond is around 2%) at the end of 5 years (red on the above figure).

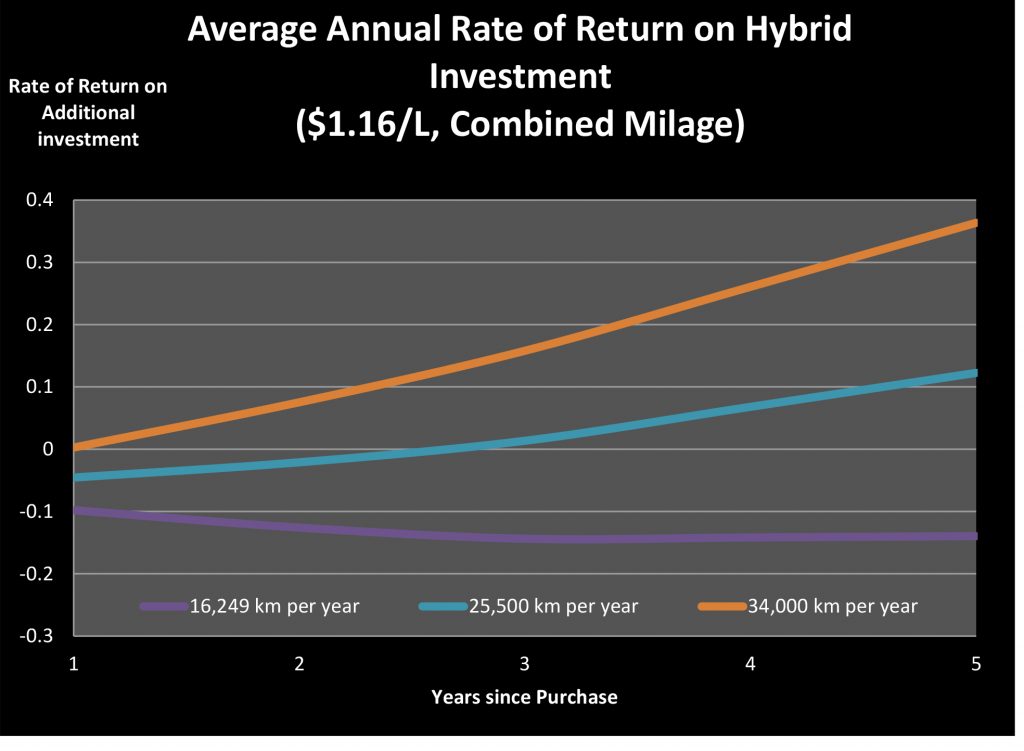

Total KM driven in a year will affect the annual return as well. Higher-use drivers will realize higher savings per year which translates into a higher “return” on the hybrid investment. Figure 2, below uses the same blue baseline (16,249 km/year at current Alberta gasoline prices). Increasing the usage of a hybrid to just over 25,000km/year (above average, but by no means an unreasonable amount of annual driving for a Canadian) allows the owner to start earning a positive return within 3 years (the green line). Doubling the average, a Canadian driving 34,000km/year will start earning a positive return within the first year.

Figure 2: Annual Rate of Return on Investment by Average Driving Distance

Obviously these are ballpark estimates. In the calculations behind these figures I have assumed that only the age (and not the total km driven) affects a vehicle’s resale price. Other factors such as the type of driving done (highway or city, summer or winter, etc.) and the maintenance schedule and costs also effect both the relative costs of owning a hybrid and the resale price of the vehicle. It is also very likely that the purchase and resale prices of hybrids relative to conventionally powered cars will be affected by the retail price of gasoline. As gas prices go up, fuel efficient vehicles become more attractive to consumers (for exactly the reasons discussed above) and we can expect the market prices for both new and used hybrids to increase.

The lesson from this is that if we treat the additional expense of buying a hybrid as an investment, it is difficult to say what the expected return will be. Low-mileage drivers and drivers who put on primarily highway miles are unlikely to earn a net return on this investment, while city drivers who put on a lot of miles probably will. It is also worth noting that modern vehicles (including the gasoline-powered Accord used in the calculations above) are becoming more and more fuel efficient every year, which reduces the fuel economy wedge between conventional gasoline and hybrid powered cars.

[5] The Kelley Bluebook price is a more accepted standard for used car prices, however, as we are discussing 2014 model years there is obviously no bluebook price available. As such I use the depreciation figures from the automotive journalists site Edmunds: http://www.edmunds.com/car-buying/how-fast-does-my-new-car-lose-value-in…

[6] 2009 data: http://www.statcan.gc.ca/pub/53-223-x/2009000/aftertoc-aprestdm1-eng.htm Associated CANSIM tables are 405-0055 through 405-0120. The vehicle survey was discontinued after 2009.