Understanding Alberta’s evolving electricity market: Volatility

On March 8, 2018 Alberta’s premier opened the current session of the legislature with a Speech from the Throne. One of the promises made was to diversify the electricity sector creating new jobs and protecting people from “wild electricity price swings”. The current session of the legislature also looks likely to introduce the groundwork for adding a capacity market to Alberta’s already complicated electricity system to attract investors through “stability and reliability”. Big changes are already underway in Alberta’s electricity system: a phase out of coal generation; the addition of more renewable generation through the Renewable Electricity program; as well as the addition of a capacity market. The addition of the capacity market is arguably the most complex and once it is implemented Albertans will not just pay for the electricity they use but also to ensure enough power plants are available to meet expected demand. It will take some years to implement the capacity market and the design details are not yet finalized, to make matters more complicated there is a rate-cap on regulated residential electricity rates until mid-2021. Either way, it appears the intention is to protect people and perhaps investors to from volatility. How you might best achieve that objective is a good question, whether it is indeed a good idea is a better question still. In this blog we focus on a simpler question: how can we tell if a capacity market will actually reduce volatility?

To understand what might happen we turn to models of electricity markets to forecast how the different pieces might play out and, hopefully, make better decisions on how to design the various components.

Modelling Electricity Markets

Over the last couple of months I’ve been talking with a number of different people about how best to model Alberta’s electricity market. Electricity markets and the interactions within them are often quite complex and any modelling exercise needs to decide what can be simplified without comprising the insights a model might bring. In helping to understand what modelling approach to use a good place to start is to think about what question or questions you are really trying to answer. To answer some questions you need to understand how the physical generation and transmission network interact. Seeking to answer other questions you might focus more on how rules and incentives will shape behaviour of different generators and consumers. Further, approaches that might help understand average prices may or may not shed useful light on volatility. Some recent modelling performed by the Alberta Electric System Operator (AESO) demonstrates this problem nicely.

AESO Results

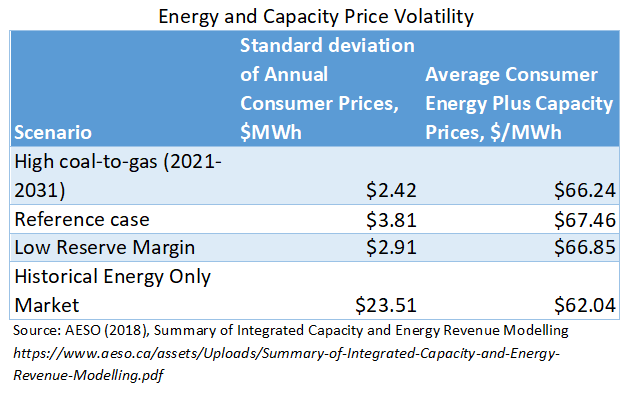

On January 26, 2018 the AESO released a report entitled Summary of Integrated Capacity and Energy Revenue Modelling as part of its work around a proposed capacity market design. That report concludes with the following table, that shows under three possible scenarios volatility under the new design (measured in terms of a standard deviation of average prices) would be substantially lower than has been the case between 2000 and 2017 and average prices would only be slightly higher.

A great result? Well not really. The AESO modelling has few problems are it relates to modelling volatility.

Problem 1: while the AESO model is set up as a Monte Carlo simulation, a modelling approach long used to represent uncertainties in model inputs by simulating results across many different possibilities, the AESO notes that due to time constraints only a single simulation was conducted for each scenario. Such an approach, will almost certainly miss those possible but difficult to foresee events that have been the historical source of volatility in Alberta’s electricity market – for example, the impact of the California electricity crisis, spring snow storms in 2010, high Alberta natural gas prices caused by cold weather in the north eastern U.S. in 2014. The absence of these events impacts volatility estimates and also averages to the extent that events the raise the price have historically had a larger impact than those that lower the price.

Problem 2: This one illustrates perfectly that difficult choices are made in modelling electricity markets. Wholesale electric prices in Alberta, sometimes referred as Pool Price are set each hour based on the prevailing conditions of supply and demand that hour. This occurs 24 hours a day for 365 days a year, given 8760 different hourly prices. Modelling an electricity market at the hourly level becomes quite complex. If your interest is limited to average annual prices it is also perhaps unnecessary, after all market conditions in the middle of the night when there is plenty of supply and low demand may be very similar from day to day. To make things simpler you can represent the 8760 hours in a year by a smaller number of representative “pricing periods” representative of different supply demand conditions. This is the approach has a significant drawback if you are interested in volatility. For example, if you select 10 different pricing periods, the price can only be one of 10 possible values and that in turn will impact your estimate of volatility. This appears to be the approach adopted by the AESO and limits you to statements about the volatility of annual average prices as they have done in the table shown above.

Problem 3: The proposed Alberta capacity market design sees, in common with designs elsewhere, capacity prices being set in an auction about three years prior to prices for energy being determined. Electricity market models tends to assume that the revenue from both capacity and energy will be just sufficient to cover the costs (including a return on investment) of a hypothetical generating unit. Models tend not to recognize that if prices in the capacity auction are determined in advance based on expectations of future energy prices and circumstances change actual energy prices, and overall consumer prices might be quite different. Put much more simply, modelling electricity markets and in particular volatility is hard.

In summary it is hard to see how the modelling results really demonstrate a reduction in volatility.

So will volatility be reduced in the new framework? It is entirely possible to make rules that will tend to reduce volatility of wholesale prices but they may come at some cost – for example, volatile prices tend to reward flexible generation and some other resources, like storage. In a world with more renewables rewarding these flexible resources look to be an important part of any future electric system. Similarly, a system that prevents prices from rising when supply is scarce may result in more scarcity (simply, financial incentives for generators to be online when you need them most work very well). It is also possible to make rules to reduce volatility of electricity prices for some consumers and leave wholesale prices unaffected. While many things are possible it is good to question exactly what kind of volatility is seen as harmful and to whom. It is worth noting that despite annual average prices varying significantly, most residential customers would have been able to choose very stable rates from competitive electricity retailers or in the case of larger customers and generators used forward purchases and sales of electricity to hedge against price changes.